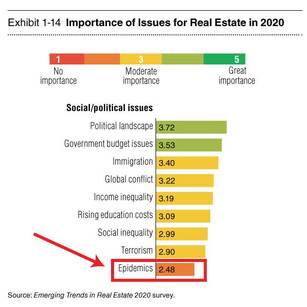

To say the housing market in Greater Boston is competitive right now is a huge understatement. While this can spell opportunity for sellers, buyers are frustrated by limited options and multiple offer situations on the houses they love. Luckily there are a few strategies that can help those offers win the property. Besides price - which is of course going to be the biggest factor - the most common reason for an offer to be rejected is that it includes contingencies where competing offers don't. In a multiple offer situation, sellers are going to choose not just the highest price, but the offer that has the best chance of a smooth closing with no surprises along the way. If one buyer has a home sale contingency and the others don't, that offer will be less appealing since the sellers would face the uncertainty of waiting to see if the buyers' current home sells before they can complete the transaction. Financing and inspection contingencies are important in minimizing risk for buyers but can also make an offer less desirable in comparison with offers that are non-contingent. What buyers can do is try to meet the sellers' preferences however they're able. A good buyers' agent will always find out which variables are most important to the sellers besides price and sometimes something as simple as adjusting the closing date by a few weeks in either direction to accommodate the sellers' needs can make a substantial difference. Buyers should always sell their current house before shopping, or confirm with their lender that they can carry both properties temporarily to avoid a home sale contingency. Having a proof of funds letter or strong pre-approval in place before house hunting is essential. Increasing earnest money and/or deposit amounts is another way to give the sellers added confidence. While waiving an inspection entirely carries added risk, buyers can include an inspection threshold where they would only attempt to negotiate issues with the sellers if repairs exceed a certain amount. This tells the sellers that buyers won't nitpick or use the inspection as an excuse to walk away unless there are major problems. Buyers should be prepared to move very quickly on properties they're interested in and usually that means looking at quite a few homes prior to making an offer so they're going in with a solid frame of reference, increasing their confidence when they do move forward on something. It also helps to be prepared to write offers on a few properties before one is accepted. We encourage buyers to shop a bit under budget to allow room both for improvements needed on a property that needs work and to make over-asking price offers that have a higher chance of acceptance. In a market with tight inventory, having a good buyers' agent is key. We know how things are changing in the local market, have relationships with other agents and can often introduce off-market properties that offer our clients additional options that they may not otherwise have access to. There may be some challenges in this market but buyers are closing on new homes with the right strategies and a little bit of patience.  As we are all increasingly concerned about staying healthy, reducing the spread of the virus and parents attempt to stay sane while continuing to work during weeks of school closures, there is question of how all of this will impact the real estate market in practical terms and overall home values. We will continue to be available to our clients, other agents and to the public as a resource for how to best move forward during the next several weeks. We have been in close communication with attorneys, lenders and investment managers and are following guidance from national and local boards. Scheduled Closings The group whose questions are most urgent are those whose moving trucks are scheduled during the next couple of weeks. Buyers and sellers whose transactions are pending should be in close communication with their agents, lenders and attorneys. Local registries are encouraging electronic recording and attorneys should be consulted for how to handle land court closings which are typically required to be completed in person. Most closing attorneys are able to accommodate parties signing closing documents separately, keeping all in-person contact to a minimum. Offers and P&S Agreements Our clients who are working on offers and purchase and sale agreements (yes, all of that work continues) are encouraged to include language to address unforeseen issues that may arise due to Covid-19 to ensure their deposits and interests are protected. Our agents have draft language available provided by a real estate attorney but each client is encouraged to work with their own team to determine what should be included for their transaction. Buyers Buyers are continuing to search for homes, but often in different ways and we are glad to facilitate that in evolving ways. Most vacant homes are still available to view and we are happy to plan private showings for clients who prefer not to attend open houses (of course maintaining our distance and carrying plenty of hand sanitizer). We have long used virtual tours and video conferencing for our out of town clients and these tools are available to anyone who prefers to look at homes remotely. Sellers We discourage sellers who still live in their homes from inviting the public through for open houses for the time being. Massachusetts has restricted gatherings of groups of more than 25 people and to ensure we comply with that number, private and virtual showings are safest for everyone. Some sellers, especially those who are living and now working at home will prefer to wait a few more weeks to list. We expect to see more pent up demand when people return to their usual routines so this could be a great time to do some organizing and cleaning to be prepared when the time is right. We are also offering mini-design consults for those who are home now and realizing their space isn't working quite the way they want or who want to redecorate while they have some time. Home Values A pandemic is certainly not something that was on anyone's radar as being a factor in real estate values (see chart below from 4CRE). What we expect to see in the immediate short term is a decrease in activity, with things quickly returning to an active late spring market. While investment portfolios are experiencing a rollercoaster, impacting some buyers' down payments, mortgage interest rates are at record lows which mitigates investment losses by increasing purchasing power. For more great information on activity, focusing on two of the hardest hit states, see this article from Mortgate News Daily. Above all, it's important to maintain perspective, and while this is new and somewhat uncharted territory, all predictions point to this being a relatively short term issue in the grand scheme of things and our daily lives will soon return to normal - with all of us being more adept at getting creative to find new ways to help one another both personally and professionally. One of the biggest and most important decisions a real estate agent can make for their business is which brokerage to hang their license with, and there's no one size fits all company for everyone. Priorities for new agents will be different than those of agents with some experience but it's always good to reevaluate every few years to make sure that the brokerage is the right one.

Some of the most important questions to consider are:

When you put your home up for sale, one of the best ways to determine the asking price is to look at comparable sales. There’s rarely a perfect apples-to-apples comparison, so a pricing decision often relies on comparisons to several recent sales in the area. As Realtors, it's our job to arm our sellers with all of the data and considerations they need to agree on a pricing strategy. Here are five criteria to look for in a sales comparison.

By Julian Lane, The Fix It Champ

When you buy a house, it’s easy to forget that the costs of home ownership go beyond mortgage payments. Houses can be fragile things, especially in the face of harsh, unpredictable weather, so you will inevitably have to spend some money on maintenance and repairs. These costs can seem hugely intimidating, but there are ways to keep them under control. Knowing When to Call in a Pro Some repairs are obvious; it’s easy to know if your HVAC is broken or if a faucet is leaking. However, some signs of damage are a bit more subtle, so it’s up to you as an owner to check whether everything in your home is in working order. For example, you should know the potential signs of roof damage, such as water stains on the ceiling and curling, cracked, damaged, or fallen shingles. Similarly, the signs of a foundation problem are not necessarily obvious, including jamming doors and sticking windows. Inform yourself on what to look out for and you will minimize big, expensive repairs. Budgeting for Emergency Repairs There is nothing worse than a sudden emergency repair bill, especially since these tend to come up at the most inconvenient times. When it comes to financing these repairs, there are smart ways and not-so-smart ways to proceed. Avoid spending money you need for other things, such as rent or bills, and resist the temptation to pull out your credit card. Above all, don’t go to a last-resort money lender, as this almost never proves to be a smart financial decision. Ideally, you should have a fund for this type of emergency; the experts at Gen X Finance recommend setting aside 10 percent of your mortgage payment every month. If you don’t have one and need the money now, consider a personal loan or a home equity line of credit, both of which are better than credit card debt. Home repair insurance is another option since it covers many of the wear-and-tear damage that homeowners insurance does not. This can be expensive, but it can be a good choice if many of your appliances are nearing the end of their life expectancy. Finding Good Contractors Don’t just go with the cheapest option when it comes to contractors. It’s almost always worth paying a bit more for a reliable contractor with plenty of good reviews. This ensures that you won’t end up with a bigger, more stressful bill when something goes wrong down the line. There are many ways to ensure you are hiring a true professional, from getting recommendations to carrying out interviews and setting out everything in writing. Of course, you won’t always require a contractor. Some home repairs, such as patching drywall or unclogging a faucet, can be done by anyone — even those folks with minimal DIY skills. However, most major repairs, as well as anything involving electrical, roofing, or advanced plumbing, should always be left to the professionals. Basic Home Maintenance One of the easiest ways to keep repair costs down is to simply prevent the damage in the first place. Regular home maintenance can help keep your house in good health, minimize wear and tear, and identify small issues before they become big ones. Better Homes and Gardens has an excellent and comprehensive home maintenance checklist, including tasks you should carry out monthly and seasonally. This is especially important in a climate like Boston, where dramatic winter weather can easily take a toll on your home. Your home is probably the biggest investment you’ll ever make, so it makes sense to keep it in great condition. Regular maintenance combined with fast response in case of an emergency should be enough to keep your house healthy and safe. In the meantime, brush up on your basic DIY, inform yourself on warning signs, and know how you plan to tackle a big repair bill. Pexels potential signs foundation problem not-so-smart ways Gen X Finance Home repair insurance many ways can be done home maintenance checklist 1. No one is representing YOU.

By going directly to a seller's agent, you are forgoing the opportunity to have someone advocating for you, negotiating on your behalf, researching the property and neighborhood, etc. Your buyer's agent has no reason to sell you on a certain house so they will be an impartial voice of reason throughout the search. The best part is that as a buyer, you pay nothing for this! 2. You may overpay for the home. Some people think they'll get a better deal by submitting an offer directly through the seller's agent because they assume the seller will save on commission. Usually the seller pays their agent the same amount whether it is split with a buyers' agent or not. Because a seller's agent must act in the best interest of their client, not only must they present all offers and help their client select the highest and best, but their duty is to negotiate a deal that is best for the seller, NOT for the buyer. Further, a good buyer's agent knows which properties in the area may have room for negotiation and which ones will take a competitive offer to be the one accepted. 3. Losing out on off-market and coming soon properties. Sure, consumers can access "coming soon" properties by combing through many websites but once they're listed there they're already pretty much public knowledge. A well connected Realtor is dialed in to what else is in the pipeline and has access to industry-only databases of properties that are about to hit the market. 4. Missteps in the process that can derail your purchase. A home purchase is a very complex transaction and one mistake like opening a new credit card account just before closing can mean you don't get to move into your new home. A buyer's agent will help ensure that the transaction goes smoothly by being a resource for negotiating the offer and contingencies, home inspection repairs, referring professionals like contractors, attorneys and lenders, making sure the financing process moves along the way it should, and assisting all the way through the final walk-through, closing and beyond. We love questions, so if you're at all curious about how to benefit from personalized, expert buyers' agents in MA we're happy to talk! We have LOTS of older Cape style homes in Massachusetts and many homeowners are looking for ways to increase their living space. With sloped second floor ceilings limiting square footage, adding dormers to a Cape can be a relatively inexpensive way to gain space.

Gabled window dormers can add curb appeal and are less costly to build, while a full shed dormer, usually done in the back of the house, can allow for the addition of a bathroom. Just a shed dormer itself may start around $20,000 but expect plenty of variation in cost depending on the size, materials used, and whether the new space will be used for a bathroom (i.e. added plumbing and electrical costs) or bedroom. Often one project means others as well, so consider whether the dormer will mean replacing an entire roof, all the siding, or other windows in the house to match. As with any renovation, it's a good idea to start with plans and choose a few different contractors to price the project, making sure to check references before moving forward with anyone. A dormer can grow to be a large project but can be kept simple and mean better curb appeal, increased living space, and higher resale value. |

AuthorTory Keith, Broker/Owner of Board & Park. Archives

March 2024

Categories

All

|

RSS Feed

RSS Feed