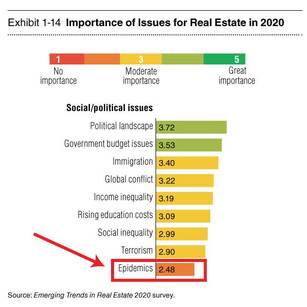

As we are all increasingly concerned about staying healthy, reducing the spread of the virus and parents attempt to stay sane while continuing to work during weeks of school closures, there is question of how all of this will impact the real estate market in practical terms and overall home values. We will continue to be available to our clients, other agents and to the public as a resource for how to best move forward during the next several weeks. We have been in close communication with attorneys, lenders and investment managers and are following guidance from national and local boards. Scheduled Closings The group whose questions are most urgent are those whose moving trucks are scheduled during the next couple of weeks. Buyers and sellers whose transactions are pending should be in close communication with their agents, lenders and attorneys. Local registries are encouraging electronic recording and attorneys should be consulted for how to handle land court closings which are typically required to be completed in person. Most closing attorneys are able to accommodate parties signing closing documents separately, keeping all in-person contact to a minimum. Offers and P&S Agreements Our clients who are working on offers and purchase and sale agreements (yes, all of that work continues) are encouraged to include language to address unforeseen issues that may arise due to Covid-19 to ensure their deposits and interests are protected. Our agents have draft language available provided by a real estate attorney but each client is encouraged to work with their own team to determine what should be included for their transaction. Buyers Buyers are continuing to search for homes, but often in different ways and we are glad to facilitate that in evolving ways. Most vacant homes are still available to view and we are happy to plan private showings for clients who prefer not to attend open houses (of course maintaining our distance and carrying plenty of hand sanitizer). We have long used virtual tours and video conferencing for our out of town clients and these tools are available to anyone who prefers to look at homes remotely. Sellers We discourage sellers who still live in their homes from inviting the public through for open houses for the time being. Massachusetts has restricted gatherings of groups of more than 25 people and to ensure we comply with that number, private and virtual showings are safest for everyone. Some sellers, especially those who are living and now working at home will prefer to wait a few more weeks to list. We expect to see more pent up demand when people return to their usual routines so this could be a great time to do some organizing and cleaning to be prepared when the time is right. We are also offering mini-design consults for those who are home now and realizing their space isn't working quite the way they want or who want to redecorate while they have some time. Home Values A pandemic is certainly not something that was on anyone's radar as being a factor in real estate values (see chart below from 4CRE). What we expect to see in the immediate short term is a decrease in activity, with things quickly returning to an active late spring market. While investment portfolios are experiencing a rollercoaster, impacting some buyers' down payments, mortgage interest rates are at record lows which mitigates investment losses by increasing purchasing power. For more great information on activity, focusing on two of the hardest hit states, see this article from Mortgate News Daily. Above all, it's important to maintain perspective, and while this is new and somewhat uncharted territory, all predictions point to this being a relatively short term issue in the grand scheme of things and our daily lives will soon return to normal - with all of us being more adept at getting creative to find new ways to help one another both personally and professionally.

2 Comments

2/16/2022 02:39:33 am

We expect to see more pent up demand when people return to their usual routines so this could be a great time to do some organizing and cleaning to be prepared when the time is right.

Reply

3/7/2022 07:09:56 am

I guess this year, we anticipate a decrease in activity, with things quickly returning to an active late spring market. While investment portfolios are volatile, affecting some buyers' down payments, mortgage interest rates are at all-time lows, mitigating investment losses by increasing purchasing power.

Reply

Leave a Reply. |

AuthorTory Keith, Broker/Owner of Board & Park. Archives

March 2024

Categories

All

|

RSS Feed

RSS Feed