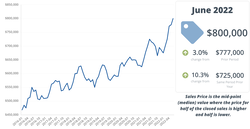

Interest rates are up almost 2% since their lows in January and are expected to increase more over the coming months. Inflation is still at record levels and stock prices have dropped substantially. With all of these variables on a national level, what does this mean for our local housing market? Those of us who stay consistently active week to week are noticing slight differences in buyer behavior but not in sale prices. As of the end of June, prices of condos and single family homes in the Greater Boston coverage area were up 3% from May and 10.3% from June 2021 so data still reflects record high prices and strong buyer demand. Looking at just the Metro West region within Greater Boston, price increases were even higher at 12.6% from May and 23.4% from June 2021. Because inventory has remained low and incomes locally are quite high, only a small section of the potential buyer pool has seen enough of an impact on their purchasing power to delay their search, while plenty of others haven't been deterred. This has resulted in sustained high levels of demand over the last few years. The resulting shift is that multiple offers now more often means three or four rather than a dozen plus and with that decrease in competition, buyer concessions like no-cost seller lease-backs and waiving all contingencies are becoming less frequent. The good news here is a bit more balance for both sides; sellers are still able to benefit from high sale prices while buyers are more likely to be able to move forward on their first choice home rather than writing offers every week for months on end. Of course, the big question left is what might happen moving forward. Based on data and what we've seen so far, it seems that another significant rate increase would begin to have more of an impact on prices, even if that only means slower appreciation. The important thing to remember is that there are opportunities in any market and markets are very hard to time successfully. Instead of timing, focusing on the costs and benefits of a specific property, its valuation, looking at a variety of financing options, and determining how long it would (or could) be held will help to reach the right decision in making a purchase or choosing to sell to move on to another opportunity. Data from the Greater Boston Real Estate Board.

0 Comments

Leave a Reply. |

AuthorTory Keith, Broker/Owner of Board & Park. Archives

March 2024

Categories

All

|

RSS Feed

RSS Feed