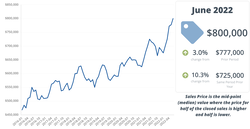

Interest rates are up almost 2% since their lows in January and are expected to increase more over the coming months. Inflation is still at record levels and stock prices have dropped substantially. With all of these variables on a national level, what does this mean for our local housing market? Those of us who stay consistently active week to week are noticing slight differences in buyer behavior but not in sale prices. As of the end of June, prices of condos and single family homes in the Greater Boston coverage area were up 3% from May and 10.3% from June 2021 so data still reflects record high prices and strong buyer demand. Looking at just the Metro West region within Greater Boston, price increases were even higher at 12.6% from May and 23.4% from June 2021. Because inventory has remained low and incomes locally are quite high, only a small section of the potential buyer pool has seen enough of an impact on their purchasing power to delay their search, while plenty of others haven't been deterred. This has resulted in sustained high levels of demand over the last few years. The resulting shift is that multiple offers now more often means three or four rather than a dozen plus and with that decrease in competition, buyer concessions like no-cost seller lease-backs and waiving all contingencies are becoming less frequent. The good news here is a bit more balance for both sides; sellers are still able to benefit from high sale prices while buyers are more likely to be able to move forward on their first choice home rather than writing offers every week for months on end. Of course, the big question left is what might happen moving forward. Based on data and what we've seen so far, it seems that another significant rate increase would begin to have more of an impact on prices, even if that only means slower appreciation. The important thing to remember is that there are opportunities in any market and markets are very hard to time successfully. Instead of timing, focusing on the costs and benefits of a specific property, its valuation, looking at a variety of financing options, and determining how long it would (or could) be held will help to reach the right decision in making a purchase or choosing to sell to move on to another opportunity. Data from the Greater Boston Real Estate Board.

0 Comments

Usually the very first impression would-be buyers have of a house, before they get inside, before they drive by and before they even read listing details is from one photo of the exterior. And if your agent is doing their job, this will be a professional high definition, wide angle photo showcasing every detail of the property. Not only will this first impression make or break whether buyers decide to find out more about the house, it sets the tone for how they're going to feel about it once they get there. As sellers you want that initial peek of the house to draw people in and have them ready to write a competitive offer. The good news is that boosting curb appeal can be incredibly easy and inexpensive (think hundreds, not thousands) and will provide a huge return on investment. Here are our must-dos for seller clients:

These quick improvements will make your home stand out in pictures and in person, equating to a faster and higher priced sale.  We all tend to be weary of commitment so plenty of homebuyers and agents alike can be hesitant to discuss an agency agreement, often until it's too late. But having a mutually beneficial agreement in place early in the process is valuable to both the client and the agent, for several reasons. For the homebuyer, a buyer agency agreement ensures that your agent is working on your behalf and will have your best interests in mind throughout the process. Since your agent is the person is advising you on one of the largest purchases you'll ever make, it's important to make sure that they're committed to you from the beginning. It confirms that the agent has no incentive to sell you any one property over another and means that any and all off-market properties can be considered as potential options. The agreement will spell out what you can expect from your agent and any compensation that would be expected to come from you as the client in the event that some or all of the amount due is not being offered by a seller or seller's agent. Understanding the structure of your relationship with your agent from the very beginning makes for a much more straightforward process. For agents, presenting new clients with a buyer agency agreement when you first begin discussing their home search will ensure that your clients are as committed to working with you as you are to them. Sometimes just having a conversation about the agreement is helpful in determining whether the client and agent are the right fit for one another. It also will allow you to search for and present off-market and for sale by owner properties without having to address how - or if - you'll be compensated for your work. And, having the agreement in place gives you the opportunity to educate your clients on the services you offer, and allows you to outline expectations for them so that everyone is on the same page and can anticipate clear communication throughout their homebuying journey. After all, very few people enter into a working relationship with an attorney, financial advisor or other professional without having some sort of agreement in place outlining what each party can expect from the other. Real estate should be no different.  How Not to End Up Homeless After Selling a Home in a Sellers' Market The competition for available homes on the market in the Greater Boston area (and across the country) has never been higher. What this means for lots of would-be sellers is that they're faced with the very real possibility of selling their current home without having found a new one. This is not a position anyone wants to be in, and luckily there are ways around it. Because demand from homebuyers is so high, sellers are in an excellent position to dictate the terms they want. What many don't realize is that this goes beyond simply suggesting an offer that comes in at a great price. A good seller's agent will guide potential buyers to draft an offer that's both strong in price and terms that allow the sellers some time and flexibility in figuring out their next steps. One strategy is to sell subject to sellers finding suitable housing. In a seller's market, it is MUCH better to ask buyers for this accommodation than vice versa. Making an offer on a new home subject to a home sale contingency is very likely to go nowhere in this type of market. However buyers, especially those who are currently renting or have flexibility in their closing timeline, are often very willing to move forward with a purchase knowing that it may take some time before closing for the sellers to get an offer accepted on a new home. A second option that can be more appealing to buyers since it allows them to close and lock in an interest rate sooner is to request that they lease the house back to the sellers for a period of time after closing. While this does come with an eventual end date it can often give sellers 60-90 days between the offer and closing plus the agreed upon lease period which is often up to 60 days after closing. Having this 4-5 month cushion plus the advantage of having the proceeds from the sale in hand before closing on the new house can make a huge difference in having both the time and budget to close on the new home. With careful planning and strategies like these it is entirely possible for homeowners to take advantage of high sale prices while minimizing the risk of not finding a new home. As with any major transaction, it is always important to discuss pros and cons with your agent before moving forward.  With extremely low inventory levels in early 2022 (just take a look in changes in inventory for both condos and single family homes in Massachusetts) and slight increases in interest rates doing little to dampen record levels of buyer demand, getting an offer accepted in the Greater Boston market is no easy feat. Over the last year our agents have seen multiple offer situations where the winning bid has included terms like free lease-back periods for the seller, all expense paid vacations, uncapped escalation clauses and of course waiving all contingencies. The good news is that there are ways to get an offer accepted that don't involve selling your firstborn child. Here are 7 of our favorite strategies, but it's always important to discuss the details of any terms you're considering with your agent:

Home inspections done by a thorough, knowledgeable inspector can be an essential educational component of purchasing a home and protect buyers against many - not all - unexpected issues that might come up. In Massachusetts, much of our housing inventory is made up of older homes so bringing in an expert who is familiar with how things were built during different decades, how they age and the nature of our climate's effect on a house can provide a wealth of information. We often get questions from both buyers and sellers about what to expect during a home inspection:

The right staging and presentation can make at least tens of thousands of dollars difference in a home's sale price. Even in a seller's market it's important to focus on cost-effective ways to showcase a property in it's best light, which brings us to tip number 1:

Just how long will it take to be moved into that new home? Plenty of first time buyers and those who haven't been in the market for a long time aren't exactly sure what to expect. Closing timelines vary based on the needs of the buyer and seller in a specific transaction; we've seen everything from a week for a cash purchase with extremely fast title work to 8 months. Generally though in Massachusetts we see closings between 30-90 days. For financed properties, most lenders will need at least a month to get through the necessary steps to underwrite a loan. Between the time an offer is made and closing day there are several key stages, some of which are simplified in the event of a cash or otherwise non-contingent purchase. The following is an example of what we commonly (but certainly not always) see in the Greater Boston market based on a 45 day closing timeline of a typical financed purchase with inspection contingency: Day 1: Offer acceptance and earnest money deposit Day 7: Inspection deadline Day 10: Purchase and sale agreement and deposit (not to be confused with down payment) Day 12: Complete loan application deadline Day 30: Mortgage commitment Day 44: Final walk-through Day 45: Closing day (sometimes the property isn't "on record" until the following day so best to plan moving trucks for Day 46) Your Realtor's job is to make sure that everything - and everyone including inspectors, lenders, appraisers, attorneys, and cooperating agents - stays on track so expect that they'll be working behind the scenes throughout the process and to be in close contact as each deadline approaches. |

AuthorTory Keith, Broker/Owner of Board & Park. Archives

March 2024

Categories

All

|

RSS Feed

RSS Feed